Implications of a Ten Day Refinery Outage

Posted by Gail the Actuary on September 15, 2008 - 10:24am

Where is our gasoline and diesel supply headed? Even before Ike hit, quite a few areas of the US were starting to see gasoline shortages. The impact of Ike can only make shortages worse. Most likely, it will take refineries at least a week or two to get production back to normal levels after a storm of this type, considering the impacts of electrical outages and flooding. In this article, I will examine some of the issues that seem to be involved. Based on my analysis, fuel supply shortages are likely to last well into October, and are likely to get considerably worse before they get better.

Insight 1. Even before Hurricane Ike hit, inventories were very low.

According to EIA data, gasoline inventories the week that Hurricane Gustav hit were the lowest that they had been since 2000, amounting to 187.9 million barrels, or about 21 days supply. Quite a bit of this inventory is needed just to keep the pipelines filled. EIA does not publish information as to how far inventories need to drop before we start seeing outages, but it is clear that we have now reached the point where shortages are developing.

Insight 2. Friday, September 12, before Hurricane Ike hit, there were already gasoline shortages in some parts of the country. These occurred primarily because of the earlier impact of Hurricane Gustav.

Even though Hurricane Gustav hit on September 1, its impact on petroleum product supplies were not felt immediately, because some inventories were still available, and because it takes a while for shortages to work their way through the pipeline. Gasoline traveling by pipeline from Texas to New Jersey takes an average of 18.5 days to make the trip, so it shouldn't be surprising that it took 11 days (from September 1 to September 12) for the Hurricane Gustav shortage to start to be felt.

Insight 3. Since Hurricane Gustav hit, there has been a drop in refinery output of 1 to 3 million barrels a day.

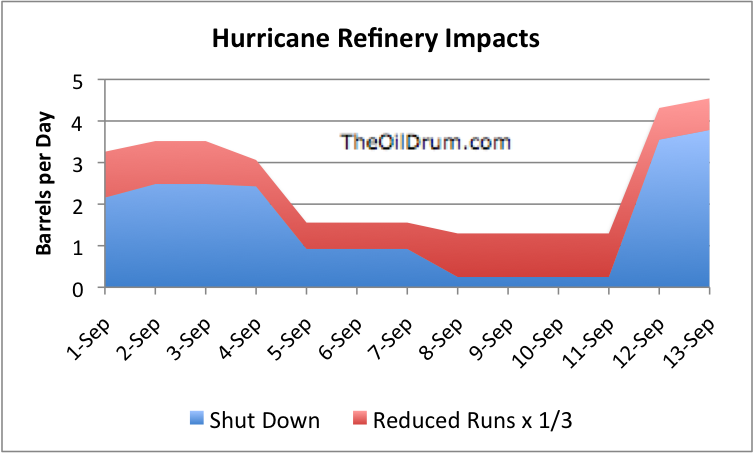

The Department of Energy releases daily reports showing the amount of refinery capacity in the hurricane area that is shut in and the amount subject to reduced runs.

We cannot know to what extent runs are reduced. For the purpose of Figure 2, I have estimated that reduced runs have the impact of reducing production by one-third. The amount shown in the graph is a rough estimate of the amount by which refinery production will decrease. It is not exact because:

(1) We don't know the extent to which production was reduced under reduced runs.

(2) I haven't adjusted for expected refinery utilization rates, without the hurricane.

(3) The data is only for the hurricane area. It is likely that the hurricanes have changed refinery production elsewhere - some increases (greater use to offset shutdowns) and some decreases (because of unavailable crude).

Insight 4. It is likely that we will have product shortages for at least the next three to four weeks, because of shut in refinery capacity and reduced refinery runs.

I have said that it is likely to take a week or two to get refinery production up to pre-Ike levels. Suppose it takes 10 days. Adding 10 days to the date of the hurricane (September 12) brings us to September 22. If it takes an average of 18.5 days to get product from Texas to New Jersey by pipeline, it will take until approximately October 10 before supplies are back to normal. It could be a little shorter than this, or quite a bit longer.

Insight 5. One of the biggest refined product pipelines, Colonial Pipeline, is now reported to be shut down, because of lack of refined product input.

Colonial pipeline is one of the largest pipelines, with a capacity of 2.4 million barrels a day. It serves the Southeast and the East Coast.

Until Colonial pipeline is back to carrying full capacity of gasoline, diesel, and other refined products, there are likely to be shortages along the gulf coast and the Southeast. The Northeast may also begin to see shortages.

Other major outages have also been reported. Explorer pipeline, carrying 700,000 barrels a day of petroleum products from Texas/LA to Indiana, is completely shut down. Plantation pipeline, carrying 600,000 barrels a day of petroleum products from Louisiana to Virginia, is operating at reduced rates.

Insight 6. The lack of refined product (gasoline, diesel, jet fuel) is what is driving pipeline outages.

Until there is enough refined product, some of the pipelines will be short of products to ship. In the immediate aftermath of Ike, lack of electricity may also interefere with the operation of some pipelines, but it is too soon to have information about these disruptions.

Insight 7. Areas with pipeline disruptions are likely to experience shortages of all refined products, not just gasoline.

While gasoline is the product that is in short supply most quickly because of lower inventories than some other products, eventually diesel and jet fuel can expect shortages as well.

Insight 8. Regardless of whether price or some other type of rationing is used, someone, somewhere will need to go without refined product, if it is not available.

If there is not enough diesel to go around, some trucks will not be able to make deliveries or some road making equipment will not be able to operate. If there is not enough jet fuel for all of the airplanes, some flights will have to be cancelled. Some auto trips will have to be eliminated.

Insight 9. If 5 million barrels of refinery production is taken off-line, this is equivalent to a little over 25% of US refined product usage.

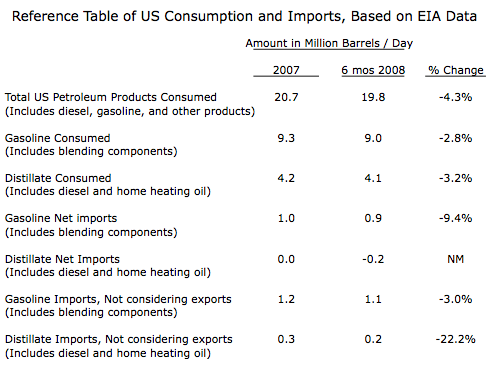

We would hope that the amount of refinery production off-line would drop fairly quickly, but it could be several days before it drops from the current 5 million barrels off-line. It will be impossibile to make up this huge shortage with imports of refined products from overseas, or the use of winter grade gasoline in summer. Edit: See reference table at the end of this article to see EIA data to compare to these amounts.

Because shortages are likely to vary by part of the country, depending on pipeline service to the area, it is quite likely some areas will experience shortages of 25% for several days, even if loss in refined product declines to "only" a shortfall of 2 million barrels a day, which equates to 10% of current usage. At 10% of current product usage, there would be a shortfall of gasoline of about 900,000 barrels a day.

Insight 10. Because some areas are likely to be very short of supply, it is likely that gasoline prices would need to rise to $10 a gallon or more in those areas, to cut back demand sufficiently.

In some areas, there may be temporary shortfalls of 25% of more of gasoline supply. To allocate such short supplies would take a very high price. Government officials are not likely to let this happen. Instead, we are likely to see many stations that are completely out of gasoline, and other stations with long lines, selling at most 10 gallons per customer.

Insight 11. The lack of diesel, gasoline, and jet fuel is likely to cause feedbacks to the rest of the economy.

If people are forced to cut back on gasoline use, they are likely to cut back considerably on trips to restaurants and other discretionary trips. Restaurants that were doing poorly before will find their business much worse. Restaurants on the brink of bankruptcy may be forced over the edge.

Some people will suddenly find their incomes lower (for example, gasoline station owners who have no fuel to sell; waitresses in restaurants; truck drivers whose trips are reduced). These people will find it more difficult to pay their bills than previously. Some may default on mortgages and credit card debt.

Insight 12. We will all get to see first-hand a little of what the impact of peak oil is likely to be.

When there are shortages of fuel, people can be expected to hoard supplies. This may cause shortages to be worse than they would otherwise be.

Co-operation could go quite a way to solving day-to-day problems. We will get to see to what extent this actually comes into play.

Allocation by price has long been advocated as the American way. We will get to see how long this lasts when there is clearly not enough supply at prices voters consider "acceptable".

Edit: Reference Table Added for Comparison Purposes

I don't see any mention of panic buying in this article, and I think that it will have a big impact, especially as news of shortages gains traction.

But is that why the mass media is not reporting this impending shortage? Are they hiding news to prevent us from panicking?

They need to report the news accurately, and it is our job not to panic, but instead be constructive and elect leaders who may be capable of dealing with a crisis without just blowing it up. The polls I read don't give me the comfort I wish I could have for that.

Do any of you think it is better for the media to keep it quiet to delay and perhaps slightly smooth the shortfall?

LOL!

CNN is covering it. They have been covering the oil infrastructure angle, and have been since Gustav. They actually sent Ali Velshi, their oil guy, to report from the heart of the storm for both Gustav and Ike. (He usually reports on oil prices and such from the studio. I didn't know he even had legs.)

This morning, they are talking about how the refineries are shut down, and how they won't know how badly they are affected until the electrical infrastructure is inspected, which might not be for awhile.

They are also reporting that gas prices may rise due to these refinery issues - for weeks or months. But they're telling people not to panic, that by rushing to the gas stations now, they're saving only a few bucks at most.

They are downplaying the idea of actual shortages, and that's probably the responsible thing for a worldwide news service to do. If people panic and rush to fill up, it would suck the system dry, even if there were no production issues.

One of their talking hairdos (based in CNN headquarters in Atlanta) said she's running low on gas. She looked for a gas station on her way to work this morning, but couldn't find one with gas. She said she passed 12 of them, and all had their signs blacked out. Some had yellow police tape tied around the pumps. She said she has enough gas to get to work tomorrow, but isn't sure what she'll do after that if she can't get a fillup.

But is this a positive or a negative?

How many talking heads do we really need?

LOL

I thought that post was pretty funny, too. And look what time it was posted!!

Leanan gets more work done in a day than any three people, seems never to leave the computer terminal, and now we see, doesn't sleep.

Is this a human being?

So I guess the question should be: "does Leanan have legs?".

:-)

Does someone have the calculation on this? For instance, I filled both cars yesterday. Both were half-full to begin with. If cars on average are half full (which seems about right except for those too poor to put in more than a few dollars gas at a time - who mostly won't be finding extra dollars to fill up today either), and the average car is driven 1,000 miles per month, then if it's getting 20 m.p.g. that's 50 gallons, or 1.67 gallons per day. Assuming a largish tank, that's 3 fillups a month. So everyone topping off their tanks should use up about 5 days' forward supply.

However, once that's done, you're looking at the normal rate of consumption - or lower, if prices really surge, since people will conserve. In fact, people are likely to delay their next fill up until they see prices falling again. So on the back side there will be a lot of people running with less-than-half-full tanks.

Looks to me like the main effect of filling up now is getting ahead of the gas stations posting higher prices on what's the same gas whether I put it in my car yesterday, or four days from now when I would anyway. The belief that good citizens should wait to buy when prices go up strikes me as the opposite of good economics, except of course for those selling the oil.

The general assumption here is that 96 hours is what the system can handle - and your figures, which sound quite reasonable, lead a one day shortfall.

We will be able to see how it works out over the next couple of weeks.

Driving will be cut back, but I don't think 'conservation' will be the prime element. It will be a lack of gasoline that will lead to driving being cut back - not exactly a replay of 1979, but along those lines.

Edit - the shortages causing cutting back being primarily the southeast/mid-Atlantic. Regions such as California and Pacific Northwest shouldn't have any problems in terms of supply.

Yes, this is a sort of Social Darwinism. Let the people who read The Oil Drum rush out FIRST and buy gas and fill up some 5 gallon containers. They can sell the 5 gallon containers for $100. You read it first here.

A good shortage now will open up the possibilities for positive public policy and private decisions.

A pinprick now to reduce the impact of a near fatal body blow later.

All good as far as I am concerned,

Alan

I think panic food buying will exceed panic gas buying.

Recently I have reconnected with an estranged relative who works in food service.

Only after speaking with him about his work am I able to appreciate how far flung our food distribution network has become and how much demand it places on our fuel stocks.

Food shortages will follow unbelievably quickly upon the heels of any disruption to liquid fuel availability.

Based on recent UK experience it takes about 3 days before food stocks on hand are depleted.

The impact of this will be interesting. Instead of entering a "visual cornucopia" with the implied promise of everything available in any desired quantity, the food shopper will experience bare shelves and picking over other people's leavings.

My hunch is that this will have a very significant negative impact on citizen psychology. Not sure how this will play out in the elections. Cannot wait to hear what the presumptive US "Energy Czarina" has to say.

What recent UK experience?

I haven't noticed any food shortages.

You did have a transport strike in the past year or two.

The reporting on this side of the pond indicated that there were shortages of most goods within three days. It was posted on the DB at the time and there were a number of comments in regard to how the urban public was lacking knowledge of JIT inventory and of their exposure to stock problems with any impairment of transport.

"shortages of most goods"? I don't think so. The problem is nowadays one or two people find a shortage then it gets picked up by bloggers and the media who make it seem like the end of the world. In fact it was just shortage of a few goods, experienced by a handful of people.

I tried to explain at the time to guru carolyn baker that reports of food shortages were severely exaggerated, but the testimony of one who actually lives in the uk's second city just along the road from plenty of supermarkets didn't qualify for her as evidence that the media reports of some national shortage situation constituted hype.

In my experience there are regularly shortages anyway of the things I want to buy because the store has the "clever" idea of selling them half-price regardless of the fact that a regular customer such as myself would be happy just to get my regular this and that for any price.

My memory of the event was of no shortages in my area, but that the government gave in to the protestors when they were informed that widespread shortages were one day away, after seven days of disruption. There were reports of some fresh foods being hard to find, but certainly no-one went hungry.

Although I don't have the numbers before me, my state(MI) alone rivals the land mass of your fair isle.

http://www.world-map.nl/maps/political-world-map-2007.gif (big file)

Hell, even our cities are huge, the Detroit metro area is sprawled over 3 counties, it takes a solid hour, with favorable traffic, to cross it in any one direction.

That is why when I responded negatively to the poster a few days ago who was commenting that the Chevy Volts' 40 mile range was overkill compared to Toyotas plan for 8 mile ranged vehicles, a 40 mile range aint squat.

Add to this the almost total lack of any public transportation means that even should fuel allocation preference, in a disruption scenario, be given to food distribution, folks are still going to have a time getting to food.

An even better bet would be that there is NO plan held by the government for such an event.

The 40 mile all-electric range of the Volt would be very nice to have.

The question is though whether it will be affordable, as the financial environment looks......interesting.....

Drive or Starve Americans

Those that, even if given food stamps, cannot put food on the table without driving. Much less get to work.

What GM hath wrought,

Alan

I hadn't realised some of the pressures within the American planning system which favour extensivity in building:

http://seekingalpha.com/article/95447-housing-bigger-isn-t-always-better...

Let's hope some of these pressures reverse soon - after all, if you need public transport to get to work, it is a lot easier if you live in a relatively dense neighbourhood, so perhaps people will be more welcoming.

Cannot wait to hear what the presumptive US "Energy Czarina" has to say.

That's easy:

"God will provide."

"God will provide."

i propose the former and unqualified chairperson of the alaska oil and gas commission would say:

"god will provide, provided that man(or woman) will drill, drill, drill, screw the moose, caribou and polar bear they are not likely to vote for me, me, me and we all know it is all about me, me, me"

We know that all Western media, right down even to small town newspapers, are now owned by a very few establishment Moguls, who have a vested interest in not panicking the sheeple.

Intellectually, it would be better for the "Truth" to be told. Practically, however, Orson Wells in the 1930's proved that the sheeple are incapable of intelligent reactions.

ALL business is in an Unconscious conspiracy to have the truth bent for their maximum advantage. I wish it were otherwise.

As always the top 10% always seem to gain advantage over the other 90% no matter which way the game is played.

Graham

Grain shortages may not be apparent while the harvest is yet underway. They might be realized before next summer, but after the harvest, if they will occur. The cost of meat might rise. Consumers might switch to bread and bakery products, hot breakfast cereal grains, and cereal to get a more efficient use of grain. It takes about eight pounds of grain feed to make one pound of beef.

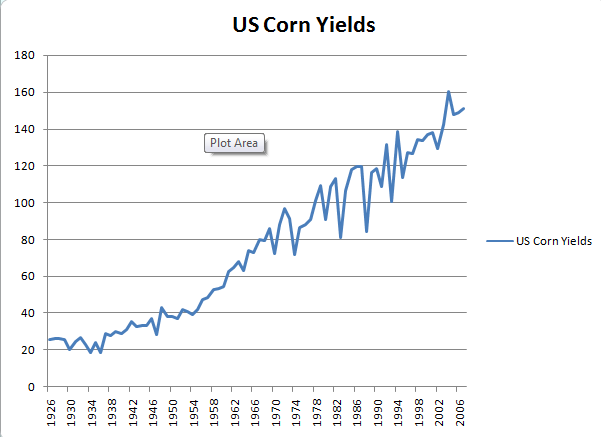

The United States has low corn inventories due to increased exports and use of corn for ethanol production. This year's corn harvest is expected to be worse than last year's harvest when inventories were higher.

The world wheat harvest was expected to be increased this year.

The United States had problems with unemployment and famine during the great depression. Unemployed people had to go to houses to beg for food, or to try to do odd jobs in exchange for food. We have seen a rapid rise in unemployment this year.

I am a futures trader. Today (Monday) front month futures are off around 20 cents at around $2.57 per gallon. Roughly speaking, you add about 1.00 worst case to arrive at the pump price which would be $3.57 a gallon.

So based on this analysis of a looming shortage, the futures markets are wrong, and I'm wondering if anyone would like to speculate as to how the front month futures price will reconcile with the pump price.

The RBOB delivery point is NY harbor. Pump prices in NJ are in the 3.30s and 3.40s today. DC up to New England hasn't topped $4 at the pump yet (after Ike).

This morning the price of gasoline jumped by 11 cents / litre in Nova Scotia, from C$1.32/ltr to C$1.43/ltr.

Rough translation, that's $5.41/gallon (3.785 litres per U.S. gallon, so $1.43 X 3.785 = C$5.41/US gal.)

Price hikes like these impact quickly on household budgets.

Meanwhile, transportation costs get passed on to the price of goods.

Airlines are already feeling the pinch.

Even with the price of oil going down on international markets, Ike's timing couldn't have been better for a perfect storm on the economy in North America.

My impression, however, most people have no idea what's coming. The experience of Katrina had already faded from the collective memory.

Not for long. The autumn of 2008 may be very well be one for history (pocket) books.

And it appears Nova Scotia Power will be granted a 9.3 per cent rate increase on Monday, the fifth rate hike in seven years -- the high cost of thermal coal is largely to blame.

See: http://thechronicleherald.ca/Front/1078558.html

Home heating oil, electricity, transportation fuels, food.... the pain will be widespread.

Cheers,

Paul

Paul,

It's interesting that on the Chronicle Herald feature page, one of the top watched videos is "Canadians angry about higher gasoline prices."

That's a no brainer. Higher prices raise tempers in people.

What is news is the level of disconnect between event A (Hurricane Ike in Texas) and event B (higher gasoline prices).

Expect a sharp rise in comments and level of unease if actual shortages start to appear.

And this in the middle of an election campaign.

Yes, I can hear it now: what are we doing selling all our gasoline to the Yanks?

Nothing like doing without to raise the national rhetoric. Should be interesting to watch unfold. Particularly with 11,000 Ontario manufacturing jobs disappearing in July and the announcement John Deere is pulling up and moving to Mexico.

http://www.reportonbusiness.com/servlet/story/RTGAM.20080902.wdeere0902/...

Don't worry, the Canadian government won't turn off the southern bound tap. NAFTA says that's a no-no. But the proportionality clause, a potential sleeper and spoiler north of the border, may receive public airing.

Cheers!

Tom

Hi Tom,

The extent of the disconnect is mind numbing; even my partner considers the recent spike in gasoline to be the result of "opportunistic price gouging". Sometimes it's better to nod your head in agreement and casually change the topic.

On a happier note, our firm recently completed a lighting upgrade at a local elementary school that will reduce their electricity needs by just over 110,000 kWh/year. In the course of our work, I discovered the school has four electric water heaters, including a 9.0 kW/450-litre tank equipped with a circulator pump that runs 24 hours a day/365 days a year. All four cylinders will be placed on timers to lock-out their operation during peak hours (an 18 kW reduction in the school's demand) and the circulation pump will be restricted to just two hours per class day. I estimate this will knock another 40,000 kWh/year from their bill (earlier this week I turned the pump off and the school's weekday usage fell from 780 kWh/day to a little over 600).

In dollar savings, placing the tanks under timer control will save the school board $1,784.16/year in reduced demand charges and a further $1,114.56 as the result of their improved load factor (i.e., more kWhs charged at the lower-cost second tier). Limiting the circulator pump to just two hours per day will add another $4,640.00 to the mix. Not a bad return from four $80.00 timers! Cherish the small victories whenever they come your way.

Cheers,

Paul

Ike may be clincher in ensuring energy frugality across the board. One can always hope. Thanks Paul for the tips.

It is worth noting that, in France, home timers for electric hot water heaters is standard in most homes. The timer is located right in the circuit breaker box. A two priced system for electricity makes it logical to bring the hot water heater up to maximum heat content during cheaper night hours. Most hot water heaters are very heavily insulated and maintain their heat for a long time. On can always over ride the standard setting if expecting company and heavier usage. Also many washing machines and dish washers come equipped with timers that allow usage during the cheaper night hours. A clothes dryer is a rarity in France.

There is a big advantage to the two price system for the supplier, EDF, as it smooths out demand over a 24 hr period.

In the UK too we have day/night rates - but you need to request them. They are deliberately made poor value by the supply companies for whatever reason.

For a start, its only from 01:00 to 08:00 [sometimes 12:00 to 07:00], then it's typically 30% - %50 of the regular flate rate at night, and 200% - 300% higher in the day!!

Hi bio1,

Shifting major loads such as water and space conditioning to off-peaks hours is a simple and cost-effective way to improve the utility's load profile and, by extension, lower its cost of service. In Canada, TOU rates and residential load control are virtually non-existent; only recently has the Province of Ontario moved in this direction. In Nova Scotia, to qualify for TOU rates you have to jump on one foot, blindfolded, hands tied behind your back while reciting the alphabet backwards (I'm exaggerating, of course... but only a little).

Next to the main water heater are the control switches for the school's massive air intake and exhaust fans. It appears they also run 24/7, even though the school is occupied perhaps 25 per cent of the time. The school is heated with two Burnham steam boilers that consume 70 litres of fuel oil per hour, each, and I'm left to wonder how much fuel could be saved simply by shutting down the ventilation system outside normal school hours (this is an older school with operable windows and so much air infiltration that an active ventilation system seems totally unnecessary).

On one hand, it's reassuring to know there are many ways we can reduce our energy use, at little or no expense and with minimal impact on our comfort and well being -- on the other, it's disheartening to think most will go unrealized.

Cheers,

Paul

I think you could teach a freezer to do the same trick.

A decent freezer uses something like 1 KWh/day with a COP of 1.5, that's ~5 MJ of heat per day that needs to be removed. The latent heat of fusion for sodium chloride(23%) + water eutectic is 0.23 MJ/kg. 22 kg of salt water eutectic embedded in the wall of the freezer could provide one day of storage at -21 degrees celcius.

With the proper incentives and programability it could soak intermittent electricity or off-peak baseload and provide additional protection from spoilage in short power-outs. It could provide an additonal load that can be dropped by the power companies in an emergency to protect grid-stabillity(they'll have to pay you for the privilege, just like they pay to be able to interrupt some of their industrial customers and it can only last for as long as there's eutectic to spare).

They use large commercial freezers in this way in the Netherlands, I believe - sorry, I don't seem to have kept the link

Large commercial and industrial customers that pay demand charges will often try to flatten their internal peak which, obviously, will not necessarily coincide with the utility's own system peak. Intelligent load controllers can do an excellent job juggling various loads so that they don't all run at the same time, often with no or only minimal degradation in service performance. What I'm doing in this case is installing time clocks to lock-out the operation of the water cylinders during normal school hours which, albeit a less elegant solution, technically speaking, is far more cost effective. Bear in mind that whereas a controller would actively monitor the school's total load and permit one or more tanks to recharge whenever there is sufficient "head room" available, a time clock offers no such accommodation and this increases the likelihood of run-outs on days of higher hot water usage.

Cheers,

Paul

Two hurricanes in about a week and the price of crude now hovers around $100. Go figure. I used to have some faith in the market to respond to reality...

I wonder if part of the low price of crude is the fact that refineries cannot use crude if they are closed. It is the price of gasoline that is increasing, since supplies are not available.

Even with the refinery's down if we only had to refine sweet light there would be no refinery issue... Its only an issue because heavy sour oil needs way more work to refine...

What should happen is a massive price differential between Light and heavy sour oil... There wont be because there are to many stupid traders...

It seems to me the market for oil has disconnected from reality. Wonder how long that can keep up??? The million dollar question..

As I said in a previous post, we learned from Gustave that hurricanes, unlike the past, now cause the price of a barrel of oil to go DOWN. The reason for this is simple: infrastructure is damaged, oil companies have additional clean up expenses, workers get paid while they are moved onshore and off. This means that the marginal cost of a barrel of oil goes up. But in this case, everyone is sad and depressed and that has a MAJOR downward force upon the futures markets as people's emotions are dragging the future markets below the cost of production. People want to GIVE oil away because they are sad and feel generous. This force, the 'invisible mind' is exerting billions of dollars of pressure on the futures markets as traders ponder whether or not there will be a future. They get sad thinking about it and we clearly have a downward spiral. Oil could plummet to a fraction of the cost of a bottle of seawater if the trend continues. Expect oil to sink into the 80s as everyone gets more depressed. This phenomenon has nothing to do with supply and demand. It is 'media-driven' and is far more powerful than these little hurricanes which are never as bad as the worst case scenarios, further exerting a downward pressure on future crude markets. This is the beauty of 'free enterprise'--just when it looks like something is going to get really expensive, people get sad, the markets get depressed, and the price of crude oil plummets. The invisible mind trumps the invisible hand.

I'm ready to take interviews on CNN to explain this to novices.

-Stiv

This is just one more little piece of evidence against Adam Smith's "Invisible Hand".

Invisible? Of course it is, it doesn't exist.

Actually, it looks like that invisible hand has just picked up a piece of lead pipe and is now swinging for the back of our heads...

Dred

I saw a cartoon titled: Why economists would prefer that the invisible hand remain invisible

It showed a dashed outline of a hand giving the bird to the viewer...sorry I can't find it to post, but i'm sure you get the idea.

It seems like a "Invisible fist" at the moment, delivering a blow to the chin.

No one said late stage capitalism would be fun.

Moose Burger anyone?

Gail, I always enjoy (feel informed) by your detailed analyses like this piece on the reasons why a gas crisis is likely imminent.

I have a friend traveling to Pittsburgh 8 hours away, leaving tomorrow night. I wish I could explain all this to him so he could use due caution.

To try to explain might make me seem like the paranoid one because the mass media does not seem to be reporting this.

Where do the masses, who can't all read theOilDrum, get this information they need??

Maybe we can get some local newspapers to print some articles about the subject, based on this article. If you know a local reporter in your area who might be interested, send a link to the article. You might also mention that I do have a real name I go by as well (Gail E. Tverberg), and that I can be reached at GailTverberg at Comcast dot net.

If the 'masses' read theoildrum, most of them would dismiss the information because it doesn't conform to their belief systems. But if they DID believe it, we might quickly morph from a just-in-time to a just-in-case social dynamic. The inflection point of this is tenuous. I'm not sure what our role is, other than to have an archive of analyses for policymakers, at all levels, to connect the dots. Perhaps they've connected them already and just don't have politically acceptable answers - I don't know.

To what extent the ruling class has achieved their top dog status thanks to their investments/job position/friends in an oil related company? To what extend for these people, to address peak oil means to cut the very tree on which they have climbed? Did you notice that the countries that are better prepared for peak oil don't happen to own a dominant oil industry? Perhaps it is not coincidence. I am really not sure the problem is one of connecting the dots, not when I see all the foreign policy adventures that just happen to target oil rich places.

thats a catch 22 - for concentrated wealth to have value, there has to be stability, reasonable equality, and things to spend it on..

and i kind of agree that there are nations better prepared for PO than ours... there are some worse, too (UK...)

Which nations are better prepared for Peak Oil?

I look at Europe and I see Germany phasing out nuclear reactors. I see a growing European dependence on Russia. I see a higher dependence on imports. Europe is further north and so solar works less well there. Also, they have higher population densities and so have less area over which to capture wind energy.

France has done well building a large nuclear fleet. Brazil has the benefit of long growing seasons for biomass energy. But few countries seem to have substantial advantages over the US.

But few countries seem to have substantial advantages over the US.

The primary advantage most countries have over the U.S. is that they use a lot less oil per capita. Thus, the magnitude of the demand side of the equation is much less daunting.

Europeans use a lot less oil per unit GDP than Americans, so any decreases in demand have a much larger impact than in the usa.

You know, that is where Kunstler steps in - Europeans have adequate infrastructure to actually imagine living with 20% of their accustomed amount of fuel - rationing would be imposed as a matter of course, priority given to such things as farmers or police, and there isn't much sympathy for those who 'need' to drive. It would be hugely disruptive, of course, but I would bet fairly long odds against riots breaking out at gas stations between normal citizens. Transport drivers organizing strikes/blockades is another subject, of course.

We will see how the next few weeks go, especially in places like the mid-Atlantic. It will be interesting to see how much of current American life is completely dependent on driving hours of each and every day.

"The primary advantage most countries have over the U.S. is that they use a lot less oil per capita. Thus, the magnitude of the demand side of the equation is much less daunting."

That's true Robert, but it can be looked at the other way around: We have so much energy consumption in the U.S. that is waste, we can afford to cut our consumption incredibly before we begin cutting into the "muscle" of the economy. We will simply be cutting fat and waste.

Europe on the other hand is already so efficient in many ways that it has little room to spare. Any major cuts will have to come out of the muscle of the economy and cut into wealth very quickly.

In the 1970's oil crisis, Europe suffered very badly. I fear for our European friends if this thing gets tight fast. Beside "case hardening" our own economy to oil shocks (through conservation, elegant efficiency design, renewables and energy diversity) we should work with our world trading partners to come to advanced and workable solutions to the world energy situation. The U.S. alone can do virtually nothing to change the peak oil situation. The U.S., Europe and Japan are not now the major sources of consumption growth, and in fact in many cases are either flat or declining in oil consumption. We should be working together to create a plan for the older slower growing but already wealthy economies (that is to say us, being Europe, U.S. and Japan) to transition smoothly to the new economic and energy order that we have long known must occur.

RC

I don't know if you have been to Europe, but the idea that it is so efficient in the use of energy that more savings would be difficult or impossible is simply incorrect - we are just a bit less inefficient than America.

Street lights, for instance, put a large proportion of their light up into the sky, increasing light pollution rather than doing anything useful.

On a more substantive note, just because Europeans do a lower mileage in more fuel efficient cars than in the US does not mean we have scratched the surface of savings.

For starters, much of the travel is voluntary, and higher prices would greatly affect that.

Here in the UK over 60's travel free on the buses, and many leave their cars at home most of the time for this reason.

10-12 seater taxibuses would also be fine for most European cities, providing convenient point to point service within minutes of their being ordered over the phone:

http://www.taxibus.org.uk/

Taxibus | Intelligent Grouping Transportation

Alan Drake has extensively documented the savings possible by using rail to move passengers and goods long distance, whilst even for those who think that financial circumstances will preclude a rapid switch to personal EV cars for most people, the technology can certainly be used to move goods from the railhead to where they are needed.

Various electric bikes and scooters can move people at a fraction of the energy use even of electric cars, which are themselves several times as energy efficient as ICE cars.

For agricultural machinery, bio-fuels can fuel that niche market.

Space heating uses a vast amount of energy, and solutions range from the use of air-source heat pumps which multiply the efficiency of electric heating by 2.5-4 times, to building better houses and insulating existing stock better.

3 million homes have almost no insulation at all in the UK, and 9 million are in the next lowest band! - That is half our housing stock.

Europe can improve efficiency many fold by applying known technology.

Good points, but you failed to mention the excellent tram systems of Germany and Switzerland and others (Poland, Czech, Austria ...) as well as superb bicycling systems (Netherlands, Denmark ...) As oil pressures mount, people can easily switch to the non-oil alternatives.

France scrapped their trams after WW II, and they are now rebuilding them. 1,500 km on the next decade, in every town of 100,000 or more.

Best Hopes for Non-Oil Transportation,

Alan

I leave the rail and tram commentary to you, Alan! :-)

It's a PIA to transport goods on a tram though, but they are fine people movers.

The main reason I get so excited by EV progress is that that will improve the basic battery technology we need to move goods around from the railhead, and to provide adequate personal mobility without needing the vast numbers of personal cars we use at present.

This will itself greatly reduce energy use, by taking out perhaps 90% of the automobile industry, and makes the spare resources available for materials for either renewables or nuclear technology build ups a very small proportion of the resources freed up.

To look at the figures a bit more closely, the link I gave previously indicates that London might need 30,000 taxibuses.

If we take the population of London at 8 million, and upgrade that to the UK population of 60 million, then you might need 225,000 vehicles or so.

Of course, many areas would be less suitable for the exact system named, as they are rural, but we can at least get some idea of scale from this rough estimate.

The UK has around 100 times that many cars on the road, and replacing all of those would be very difficult, certainly in our straightened financial circumstances, but 225,000 is a very different matter and should be do-able as hybrids or EV's in fairly short order.

If they were EV then fast-charge batteries would be needed, but some designs allow this.

Large numbers of electric delivery vehicles would also be needed, but again relative to the number of cars we are talking about small numbers.

There would not seem to be any show-stoppers to provide the goods and transport people need, although if most of our projections for the financial system are accurate, not for business as usual.

The more spread out suburbs in the US and Australia make things tougher, but if increases in waits were allowed then the number of cars needed per square mile decreases by a square function.

In practise, it should be possible to do quite a bit better than this, since reduced personal mobility should lead to clustering of functions near transport nodes, with shops and offices being built near rail or tram stops, and so most journeys would be from houses to these central points, a lot nearer than the city centre.

visiting other people's houses in these low-density suburbs would probably be limited to bikes or electric bikes.

Yes, but doesn't European freight basically go by truck? In that respect, we are better off in the US with some significant share (don't know what %) going by rail.

You are quite right Liz - and that is another area that Europe could save a lot of energy! An awful lot of the rail traffic in the States is coal though - Alan will know how much.

There is not so much coal here to shift around.

Coal is trending down to a third of US rail ton-miles (roughly). Low value commodities (coal, grain, gravel, bricks, etc.) are about 2/3rds of rail ton-miles (all from memory).

Alan

Yes, today. Although the EU uses coastal shipping much more than the USA, and their RRs are largely electrified.

There is a major push for a shift to rail, which will bear fruit. The Chunnel is rail (piggyback trucks or take a ferry) and the Swiss are digging a flat straight rail line between Zurich & Milan (for Germany-Italy shipments, among others) while competing trucks will have to grind gears over the Alps or go piggyback.

A rail & road bridge from Sweden to outside Copenhagen Denmark with an on-going link to Germany from Copenhagen under construction (rail only I think).

A new freight only railroad from Spain to the Baltic is under way as well.

Allowing multiple carriers on national railroads is also underway.

Best Hopes for EU Rail,

Alan

Yes, this is true ... however, ALL activities have consequences in the US economy. That large 'fat and waste' segments of US productivity are measured. Fatting and Wasting generates income! Should this activity be removed, it adversely impacts GDP.

The cutting process itself will also be measured - and fixed as an cost/expense to be held against the income that is generated by the fat and waste.

It is far more costly overall ... to conserve than it is to waste. Add the effects of compounding and the cutting of fat and waste leads naturally to an almost unimaginable economic collapse!

This is how energy and auto company lobbyists can tell Congress with a straight face that conservation will send Americans back to the Stone Age.

This truism is a key component to the political resistance to changing the overall energy paradigm--from NIMBYISM to vested corporate interests et al. When thought about, this is THE major factor why the US doesn't have an energy policy worthy of the name. Carter tried to illuminate this truism and was defeated by its constituent parts acting in their own selfish interest (amongst other things). The only politicians bold enough to ennunciate this truism are marginalized members of congress. Until the "disconnect" mentioned above is connected to the truism highlited here, there will be no effective movement toward an effective energy policy that in essence is also (for the time being and global warming aside) a transportation policy.

Moreso is religion, particularly Christianity:

"Go Forth and Multiply!" ( ... like rabbits) (Gen. 24:2)

"Trust in the Lord with all your heart, and lean not on your own understanding; in all your ways acknowledge Him, and He shall direct your paths." (In other words, don't believe your lying eyes!)(Proverbs 3:5)

"Blessed is the man who trusts in the Lord, and whose hope is the Lord. For he shall be like a tree planted by the waters, which spreads out its roots by the river, and will not fear when heat comes; but her leaf will be green, and will not be anxious in the year of drought, nor will cease from yielding fruit." (Jeremiah 17:5)

And so on and so forth. God made the world for our (business) purposes, we are obliged to exploit it to serve God and if things turn out to be 'not so okqy' to trust that this is all part of 'God's Plan'.

We all need hope, and Christianity and many other religions give us that. I am sure things were very difficult back in the time when those verses were written, and the verses from Jeremiah and Proverbs helped people get though the difficult times. The same verses help many people dealing with death, cancer, and other illnesses today. The verse about going forth and multiplying made sense back when death rates were very high, and few children would make it to adulthood.

I agree that there are people who interpret the Bible the way you suggest, but there are a lot of others who do not.

I would prefer that people stay away from religion bashing. Many readers find it offensive.

100% agreement.

Moreover Christianity, as well as other religions, is about community.

Something that we here at TOD try to embody.

Not shure that is really fair. People have been taught how to read scipture incorrectly, to approach The Divine through an intermediary - the cleric and the church. A Power and Control thing. The scriptures often are refering to "the spirit within" in a sense of direct relationship of Person to The Divine.

I think what I'm saying is: The Scrptures have been quoted out of context since the day after they were written.

In other places the scriptures had exhortations specific to the time period when they were written, Go forth and multiply was a survival instruction, and they have grown outdated with time.

There is a lot of knowledge hidden in the scriptures.

Well that's my non religious persons perspective.

It is not a person's belief and spirituality that is to blame as these often come from a search for a loving creator in a cold, dark, difficult to understand, universe. It is not a person's hope for life after death that is the cause of these troubles. It is instead the exploitation of hope for profit and power and the blackmailing of hearts by claiming 'only we know the way to heaven; follow us or suffer eternal death.'

I look to a person's faith and conviction as a sign of a good heart. Hope moves you forward. Belief strengthens hearts and hands. A search for justice and meaning gives value to ourselves and others. And the idea that benevolence is its own reward has immeasurable benefit to all.

It is in hubris, when we claim to know the way for others; when we claim to act in God's name, that we lose our way. For my part, I believe we would do better to let our charity and love be the best signs of our faiths -- our means of reaching hands out to others and inviting them to share with us in this strange, amazing journey.

"That's true Robert, but it can be looked at the other way around: We have so much energy consumption in the U.S. that is waste, we can afford to cut our consumption incredibly before we begin cutting into the "muscle" of the economy. We will simply be cutting fat and waste."

I think this is precisely incorrect, actually. I think the problem is that the fat and waste *are* the muscle of the economy - 70% of our economy is driven by consumer spending, and continual growth is required - a contraction in fat and waste sends the economy into crisis. I hear this idea that we can just stop our wasteful spending, and do only what matters often, but I think it is truly wrong - there is no way to easily or rapidly decouple waste and its economic power from truly useful economic activity.

Sharon

The economy can shift gears faster than you suppose.

Long lived energy efficient capital spending can become the focus of an economy in a half dozen years. Retrofitting insulation & windows & solar hot water heaters can take the place of new Exurban McMansions.

New Urban Rail and expanded & electrified railroads can take the place of new roads as well as consumer "goods".

Add a Rush to Wind, HV DC transmission lines and pumped storage can be another significant source of economic activity.

Quality before quantity can be the new focus for consumer goods. High end e-Trikes anyone ?

MASSIVE dislocation, but people can and do adapt.

Best Hopes for Better Economic Focus,

Alan

Alan, I think you are correct that these things *can* happen - the question becomes how likely they are to happen. I certainly would like to see them happen, but I think there are real questions about our ability to borrow enough money to make such a major economic shift - and it would have to be borrowed, I think. I also think the question becomes what kind of economy they can move. I don't doubt we could change our economy quite rapidly (although what that middle point would look like is another question).

But I do think there are real questions about what a sustainable economy that focused on durables would look like - and on long term economic planning issues - that is, we might, with a great deal of work and planning, make the shift to an economy based on insulation and rail and durable consumer goods. I can buy that. But then what does the subsequent economy move on? What happens when the rail is mostly built, and everyone has their good for 25 years trike and the house stays pretty warm with minimal fuel? That is, you are talking about a transitional economy - what is the long term sustainable model?

I think we're going to make major economic shifts, regardless - hopefully more as you describe than I suspect. But I also think that at the end, we're probably going to be poorer. In itself, that's not necessarily a horrible thing - our affluence has been a terrible, terrible thing for us in many ways. It has its pluses, of course, but the price has been too high for the world and the future. The question becomes how we get to an economy that isn't based on yet another big boom - whether it be in rail lines and insulation or nanotech - but on a steady state. And as deeply as I admire the steady state economists, I'm not at all convinced that they or anyone else has figured this one out yet.

Cheers,

Sharon

Even long term capital goods need replacement. Wind turbines have relatively short 25 year lives (new & improved ones perhaps longer, the towers & electrical infrastructure at least twice that).

Some long term & long delayed environmental clean-up efforts will take economic resources in the future.

I could see massive railroad tunneling and other civil projects keeping people busy for decades (we never double tracked the original Trans-Continental railroad through the mountains, the tunnels and fills built by Chinese coolies are still used today, although the bridges have been replaced).

Many opportunities for run-of-the-river hydroelectric projects for example. Trash recycling of our garbage dumps is an untapped resource, etc.

The pace of technological progress may slow, the direction will surely change, but it will not stop. Thus I think a completely "Steady State" economy will not happen.

New varieties of teff & quinoea, new hybrids of apricots and plums, new rail ties, etc.

Best Hopes,

Alan

I agree with you to a degree, Alan - I'm not suggesting that we will build out and then never need anything again. But I do think that the transition from a "next big thing" economy to a fairly stable, low level one, that mostly replaces durable goods and cleans up messes, is, even in the best case scenarios, something that probably deserves more thought and analysis than it has gotten. We know it has to happen - and that it will one way or another. But actually living in a less-but-still industrial society without large scale growth is something we don't have a lot information about.

Using current models, this would mean we'd be a lot poorer - and again, I'm not sure that's necessarily the worst thing that could happen, particularly if we can transition to a kind of self-sufficient poverty, the kind that people talk about when they say "I was poor, but I didn't know it, there was always food on the table, and Mom kept my clothes patched." But there's also the other kind of poverty - the kind we've been setting ourselves up for - that's the part where you don't have food, and are cold or hot and scared a lot of the time. And while I'm doing my level best, and you clearly are too - to get to the good kind of lower economic transition, and I think we both hope for one, I'm not sure that I believe we will (as opposed to should) make that shift in a short time, in a way that wouldn't be painful. Because we're working so hard going in the other direction.

Again, there's no question that I agree with you in many respects - I do think that we need to think a little more about the long term replaceability of technological infrastructure given that 25 years out, we would have to replace those turbines, and right now, we use fossil fuels to do it - our plans have to include that, and don't really. But generally, I have the same hopes you have, but some other fears.

Cheers,

Sharon

Alan, Sharon,

Rows are getting thin, so I try to keep this reply concise.

From my European perspective, the Wikipedia entry on the Republic of Ragusa [1] offers a glimpse at the underlying forces pertaining to the aforementioned hopes and fears, particularly the chapter on the relations between the nobility.

Carefully not trying to tread on sovereignity issues, I'll leave it to your appreciation of this reference to determine where to go from there.

Plus I'm not sure if this still fits under "Implications of a Ten Day Refinery Outage".

Hope this helps,

Serge

[1] as retrieved on Aug 4, but content seems to be pretty much stable.

But our waste is an opportunity as much as it is a problem. We have more easier ways to cut energy usage. We have more optional energy usages.

We can right now afford bigger cars and drive them. We can later afford to shift down to cheaper smaller cars. The Europeans already drive smaller cars. Granted, there's pain associated with that shift given the rate at which cars turn over. But the car companies can shift to just building compacts and subcompacts which higher mileage drivers can buy.

We also have more energy than Europe. We have much more oil, natural gas, coal, wind, solar.

A higher portion of Europeans already live in multi-unit dwellings with smaller numbers of square feet per person. We can make that shift. In some cases we can make that shift just by converting houses into apartments. I live in a town that has a lot of those conversions. So I see it is possible.

We also have more areas which have moderate climate. We have running a multi-decade migration toward moderate climate areas. Swedes in Sweden can't get away from cold weather without piling into southern Italy where they do not speak the same language. Mainers can move to Virginia, Tennessee, North Carolina.

On the other hand I guess Swedes have triple glazing and lots of hydro per capita and are more at home with cold weather than we'd expect anyway. Like why haven't people all left Scandinavia and Russia already anyway?

In Germany, you see the democratically expressed will of German citizens in phasing out nuclear power, recently given a boost due to the lying and incompetence of a not quite declared 40 year old nuclear storage area which is now being flooded - Germans have a real problem with long term problems, and nuclear waste is a long term problem. The recent accidents at a couple of French nuclear reactors didn't help the pro-nuclear cause either, by the way.

You also did not mention German efforts at home insulation, solar heating, PV, or wind - or the fact that the Germans hope to make money exporting such energy conserving or energy producing technology.

Whether measures will be taken in the future (many Germans have reasonable concerns against nuclear power, which could be allayed with reasonable solutions) about nuclear power is one thing, but the current fact is that Germany seems to be preparing for a future where the current assumed abundance of free energy will no longer be seen as realistic.

Both Germany and Britain seem headed for electric power generation capacity crises. Germany is phasing out nuclear power at a time when it can not afford to do so. Britain's reactors are also going offline creating a generation gap in the late 2010s.

France seems pretty well positioned by comparison. Its wind and solar will come on top of a huge nuclear base. So it will have the lowest vulnerability to fossil fuels.

Britain will be very vulnerable a lot sooner than that.

If there is a bad winter this year and restrictions on Russian gas exports cuts could happen this winter.

By 2013 or so then the vulnerability becomes extreme.

Here is a link to the decrease in nuclear power:

http://www.jaea.go.jp/04/turuga/tief/2004/images/S1_04.pdf

S1_04.pdf

Coal plants are also due to be decommissioned as some do not meet EU regulations and are ageing.

The contribution from all the wind turbines in the country currently equals the output from one small coal or plant or around half of one nuclear plant on average - the industry commonly states it's output as installed capacity, which hugely inflates it's output and puts it's costs in a favourable light.

http://www.telegraph.co.uk/opinion/main.jhtml?xml=/opinion/2008/09/14/dl...

Off-shore wind is an excellent resource for obtaining taxpayer's funds, but is hugely expensive - around three times the cost of the already far from cheap on-shore wind.

Germany has a phase out plan that lasts until 2025 - and the political pressure to keep the reactors running is high. Not supported by a majority, but still high - the energy companies would like to keep them running. Of course, at least one energy company EnBW, was arguing that they needed to keep the reactors running to reduce their reliance on coal, and begging to be allowed to keep them running. Then two days later, submitted paperwork applying for 10 new coal plants, regardless of whether the reactors were kept running. The energy companies have close to zero credibility in these debates.

Admittedly, a certain number of Germans are anti-nuclear for non-technical reasons - superstition concerning radiation (for lack of a better expression) is part of it, as is pacifism - most reactor designs have much more to do with military aspects than most people seem to realize (for example, there is no technical reason for commercial reactors to produce bomb grade materials, except for the fact that is how they are designed).

However, most Germans who oppose nuclear power base their reasons on concrete grounds - the unresolved issues concerning waste disposal (as is again on public display here - including clean up costs that are not going to be paid by the power companies, and which will not be included in their demonstrations of how 'inexpensive' nuclear power is), and the relatively fragile designs of currently running reactors. If these two issues could be resolved (some posters here insist these problems have been resolved), Germany would likely continue to use nuclear power. Especially if the issue of bomb grade materials could be resolved, as then many pacifists would have their major objection met.

German opinion is actually pretty evenly divided:

http://www.planetark.com/dailynewsstory.cfm/newsid/49280/story.htm

I believe the recent problems at Asse have shifted those polls a bit -

'The debate over Asse has particularly caught the members of the conservative CDU party off guard. Just a few weeks ago, CDU General Secretary Ronald Pofalla praised nuclear power as “eco energy” -- a statement that is now hard to reconcile with reports of leaky storage drums and radioactive contamination. “In order to proceed with our plan of extending the operational periods of nuclear plants, it is imperative that we make progress on the issue of a deep geological repository,” Podalla said.

For years, the conservatives have favored using another salt mine for final waste storage, the facility at Gorleben, which is geologically similar to the one at Asse. They have done this because pro-conservative energy companies have already invested a great deal of money there and because they fear that alternative sites could spark a wave of protest movements in their own backyards. This could happen, for example, in the region surrounding the city of Ulm, which belongs to the constituency of Germany's federal minister of education and research, Annette Schavan (CDU).'

http://www.spiegel.de/international/germany/0,1518,577018,00.html

The article is essentially political, but some of the technical details will be very damaging to the nuclear industry, such as this -

'König’s experts have been working for weeks on an alternative. They want to remove the old barrels of waste, or at least some of them. Nevertheless, such a retrieval operation would take time -- a factor that is lacking in the assessments made to date. Official reports state that the security of the mine is only assured until 2014.

In light of this extremely tight time frame, it comes as no surprise that a new leaked report from an engineering firm in Bochum has raised many people’s hopes. According to this paper, taking appropriate “security measures” with large amounts of concrete could keep the mine from reaching a critical stage for another 10 to 15 years. “The essential thing right now is to gain time to find the best possible solution for sealing the mine,” says König. If there is an opportunity to do this, then “we have to take advantage of it.” (Translation note here - 'security' is probably better read as safety or containment)

And remember, this is all at German taxpayer expense - the nuclear industry isn't going to pay a penny of it.

The nuclear industry continues to show a disdain for future problems which is simply not acceptable in Germany, and they will do anything to distract from their major weakness - the fact that in x number of years (at Asse, around 6, if nothing is done - first problems being noted in 1967, as documents are now reveailing), radioactive goo will be bubbling around in the biosphere.

The opinion polls have been pretty constant over a number of years.

I do not know what the fiscal arrangements in Germany are for disposal of waste, but in the UK the levy is £0.50/MW generated.

Since disposal costs take place in the future, discount rates make the charges relatively slight.

France reprocesses and stores it's wastes, and has much lower electricity rates than Germany, with no substantial evidence of subsidy bankrupting the French state.

In addition, in spite of Germany paying large sums in renewables subsidy, in practise it's energy is based on very dirty coal, and it's emissions of CO2 are far greater per person than France:

http://business.timesonline.co.uk/tol/business/industry_sectors/natural_...

The man behind the nuclear power shift - Times Online

The cost difference between German electricity supplies and French supplies with increasing shortages of fossil fuels may be assumed to increase in future with increasing costs for fossil fuels.

Plenty of radioactive goo is bubbling around due to releases from the coal industry which Germany has preferred.

I am certain there is more Spiegel information about the problems in German, but the main point is that the storage done at Asse was incredibly sloppy, to be charitable, or criminal, as will be determined by a court. And that the current stabilization - clean-up is being far to charitable again - is completely on the tab of the taxpayers, not the nuclear industry.

In Germany, the nuclear industry has pretty much lost whatever credibility it had managed to accrue for itself (mainly through massive amounts of money directed at media and politicians) again, because what is coming out of Asse is really unbelievable - basically, out of sight, out of mind is how the nuclear power industry has been handling the issue of waste.

The problem is, the stuff won't be out of sight for much longer, if nothing is done - and doing nothing is exactly what the nuclear companies have been doing since 1967, where the first reports of problems surfaced.

Germany will have to make hard choices - which is why so many houses around me are being insulated, and the installation of PV (regardless of efficiency, it is still electricity) continues at a fairly noticeable pace.

However, the same companies that want to keep the reactors running are the same companies that burn coal - it is not an either/or proposition. Which is why the Greens seem so radical at times - they are attempting to change how people live, and as time goes on, the idea of conservation is becoming less radical, except for the energy companies, of course. Homes are being insulated because it works out on a monetary basis for the owner, not because it is some moral or ethical statement. The same is true of solar water heating. However, viewed from an energy company perspective, the homeowner's gain is the energy company's loss. And considering that in most industrial countries, the companies have much more political power than normal citizens in terms of policies, Germany stands out.

Again, I am not really an opponent of nuclear power - I'm an opponent of 70s or earlier style power plants, and the problems of waste are still unanswered, in part because the nuclear power industry doesn't want to have bear the burden of paying for it, while complaining about how expensive alternative energy is.

Yeah, who needs an opposition to nuclear power, when the British and German industries do such a good job of it!

About ten miles down the road from me there is an industrial estate, where the rate of ill-health is noticeably higher than the norm, and in that area the chemical industry is large.

The coal industry routinely kills thousands or millions, and permanently damages the health of vast numbers of people especially in the third world with air-borne pollution, but that appears to be relatively acceptable.

There is a complete lack of proportionality from many of the critics of nuclear power, although of course any reasonable person would be cautious.

In Japan, an earthquake damaged some of the ancillary structures, and the main reactor was not in any danger whatsoever.

This was confounded with much more severe accidents, in the same way as renewables are almost invariably quoted by their installed capacity rather than their actual average hourly output, which is way lower, and lays bare how colossally expensive much of it is.

At least in Germany something is being done, houses are being insulated, they lead in Green roof technology and so on.

Here in the UK we have some of the worst insulation standards in northern Europe, little gas storage, both reactors and coal plants being taken off line over the next few years, and no apparent sign of any realisation of the gravity of the problem, let alone urgency to deal with it.

France is by far the best prepared major western nation to deal with peak oil.

Some years ago, communism died.

It is now apparent that laissez-faire capitalism is also taking a mortal blow, and French derigism has done a far better job.

Pakistan is well prepared for peak oil.

More than two-third of our population lives in villages and grow food almost the traditional way. There still are old people alive who have seen 1950s when there was no green revolution and agriculture was done in traditional way. Houses in villages are built with red bricks made of organic matter that both provide coolness in summer and hotness in winter. Almost every house in villages have life stock in form of a dozen buffaloes, cows, camels etc and five dozen sheep, goats etc.

One third population of pakistan that live in cities are used to of 12+ hours of no electricity at regular basis. Most work is done by hand in factories. Lot of loading work is done by donkey carts.

We have world's highest reserves of coal, 200 billion tons, 20% of world's total reserves. We are self sufficient in natural gas and have enough supplies of it to last for decades at our level of consumption. We produce one quarter of our petrol and can increase it to half if we get peace in region by american troops going back from afghanistan.

About half of our electricity is produced by dams which are supposed to stay there for 20,30 more years. We can produce enough electricity by making more dams such as kala bagh dam etc.

We have a large army, self sufficient air force, advanced navy, very very high tech missile technology, nuclear capability.

On international level we are the only friend of china, we have brotherly relations with arab nations, turkey, indonesia etc and friendly relations with iran.

We have enough power at all levels to swallow afghanistan once usa troops are withdrawn.

Our banking system is still intact. We not had any losses in sub prime mortgage crisis. We are not overly consumptive. We are not trapped by credit card loans.

The media can't fool us because we have variety of channels on our tv including cnn, bbc, al jazeera as well as vast and diverse local tv channels. We have a large diversity in newspapers available that cover voices from americans to talibans to arabs to chinese to russians to far easterners.

There is no unemployment in pakistan simply because we are not high tech and all work is done by hands.

A quick peruse of the data leads to an altogether different asessment.

Here are two charts from the Energy Export Databrowser. The top one shows Pakistan's crude imports measured in constant (2007) dollars. The bottom shows Pakistan's coal production/consumption and import/export.

I would say that Pakistan is particularly vlunerable.

Sure Pakistani fossil fuel consumption increased with time. Sure we are still an importer of coal but one can't deny that we have the world's largest coal reserves which amounts to 20% of world's total reserves. The decision of not extracting them is political based on perhaps the idea of not showing fossil fuel reserves to avoid an iraq-like invasion by looters. It still not change the fact that we produce quarter of our oil.

Whatever happen our friendly relations with both middle east and caspian sea countries and our geographical closeness to them guarantee us a secure supply of fossil fuels.

Huh?

According to BP Annual Energy review, Pakistan has 3/10s of 1% of world coal reserves - about 1% of those of USA.

Perhaps your leaders are 'smart like foxes' and are hiding these reserves from world geology experts, I couldn't know.

We recently (one to two years back) discovered 200 billion tons of coal reserves in thar desert in sindh province. It was reported by top local newspapers such as jang, dawn, ummat etc. BP annual energy review you quoted ofcourse is not always updated as we recently noticed many countries' coal reserves not being revised for as much as 50 years.

Perhaps pakistani govt is not utilizing the coal reserves in local industry to save the agriculture sector (that contributes to 25% in gdp and provide over 50% of jobs) from pollution. We not have that much industry anyways and we can't develop it at present given the wars in the region.

Anyways, its wise to hide your wealth in a robberer's world.

Congratulations on your country's discovery. I'm sure the Chinese are overjoyed.

Do you think the Chinese govt could call the nuclear bluff of the Pakistani govt? Would they invade by land right the way from North to South? Or by sea to the coast near the coal stores? Or would they form a friendly agreement, leaving India as the odd-one-out? Or might they all co-operate in peace while trashing the global environment for everyone else (or not)?

Nate Hagens, you said,

"But if they DID believe it, we might quickly morph from a just-in-time to a just-in-case social dynamic."

EXACTLY CORRECT.

But the "just in case" dynamic is not well received, sometimes not even among those you would think would accept it.

Not long after I started posting here on TOD, I posted several times on the idea of "case hardening" our culture for energy shocks in EITHER direction, up or down, increasing diversity of fuel supply and transportation patterns, and "real hedging" as opposed to the "mock hedges" being peddled by the hedge fund industry.

My posts were poorly recieved. The consensus here seemed to be that I was talking about "nationalism" (in one way I was, but not in the way it was percieved here) and my acceptance of the possibility of oil price declines as well as increases was dismissed as ludicrous. My ideas for transportation diversity and redundancy allowed for the continued use of the private automobile and truck haulage industry and was dismissed out of hand.

Now, views are beginning to change. It is being seen that if current models of peak oil as put forth by the guiding voices of the peak community are correct, the U.S. can do absolutely nothing about peak oil on it's own, it can only hope to stabilize and "case harden" the U.S. economy to energy shocks. This is not some old fashioned "nationalism", it is purely a statement of fact. We can best serve the world by doing what is best for us, that is, reducing and diversifying consumption patterns.

The idea that oil prices can indeed drop fast is now being accepted, as an economy once damaged by oil price increases is not being damaged by hedge funds who bet long and wrong (at least in the short term) on oil prices and other commodities. We have only seen the tip of this iceberg to this point. Pension funds, state and municipal pensions, university endowments, bank and mutual fund money are now tied up in these funds and their bets. A fast drop in oil prices could be catastrophic to an already weakened economy. Those who wish for a fast return to $40 per barrel oil do not know what they are wishing for.

The idea that the use of the private automobile and the tractor trailer can be ended quickly is equally ridiculous. It cannot be, and it should not be. The transportation system is a life support system in so many ways it is impossible to explain in any post that does not equal the lenth of a book. But kicking the legs out from under a system that relies on private and flexible transportation because the fuel price is now at some half price compared to what Europe has paid for years would be "throwing the baby out with the bath water" in the wildest possible extreme.

So, back to your basic point Nate, yes, a just in case structure using our common sense and reason is exactly what is called for.

Panic and hysteria will destroy us fromt the inside much faster than peak oil ever could IF we allow it.

"If you can keep your head when all about you....", you'v heard it before, but now is a good time to remember it.

RC

ThatsItImout:

"The idea that oil prices can indeed drop fast is now being accepted, as an economy once damaged by oil price increases is not being damaged by hedge funds who bet long and wrong..."

I believe you meant to type "now", correct?

Your right damfino, It was supposed to be "now". Sorry for the delay in correction, we just got electric power back in KY!

RC

It is irrational to believe that you can engineer societies or nations. We have an abundance of examples to prove that it can't be done. The idea rests on the notion that a very few know what is best for all the rest. That the managers are omniscient.

Disagree. If I understand correctly, Stalin dragged Russia out of the 18th century to the 20th in a couple of decades and thereby sprang a surprise on Hitler. And something similar with Mao in China and Castro in Cuba, notwitstanding how much these notions might stick in an American "democrat's" throat.

Sure, the process is imperfect, but the self-designing society of individuals isn't exactly proving too brilliant either just now is it? Worth considering Arnold Toynbee's point that civilisations were founded on the basis of a creative minority giving leadership. Just we now have the stage of decadent dominant minorities instead giving anything but leadership.

I think some people who live in cities take the attitude that since they can get away without driving that basically a pox on those who drive. But people who live in cities on average have less need for suburban houses than those who live in suburbs. Lots of young people go and live in a place like NYC and SF until they have kids. Then they suddenly rediscover the virtues of a house with a yard where the kids can play and safe neighborhoods where the kids can bicycle.

"........until they have kids. Then they suddenly rediscover the virtues of a house with a yard ......."

a prescription for continued unsustainable overpopulation.