About

Almanac Trader

I am the editor of the Stock Trader's Almanac & Almanac Investor Newsletter and Chief Market Strategist at Probabilities Fund Management, LLC. I use historical patterns and market seasonality in conjunction with fundamental and technical analysis...

+ FOLLOW THIS TUMBLRMrTopStep Open House

Register Here:

Open House | MrTopStep.com

Our friends over at MrTopStep are at it again…

Starting Monday, February 19th, they will be opening their doors for a week long look inside their social trading forum. They have a great lineup of professional traders who will be available to you all week sharing their ideas, trade setups, and answering questions.

In addition, there will also be daily presentations showing the features of their IMPRO trading room, insight on tracking opening and closing imbalances, and they have a microphone right in the S&P 500 futures pit on the CME floor so you can hear all the action LIVE.

I’ll be there listening in, and I suggest you give it a shot too, and see what these guys have to offer.

Presidents’ Day: Long-Term Record Bearish Before & After

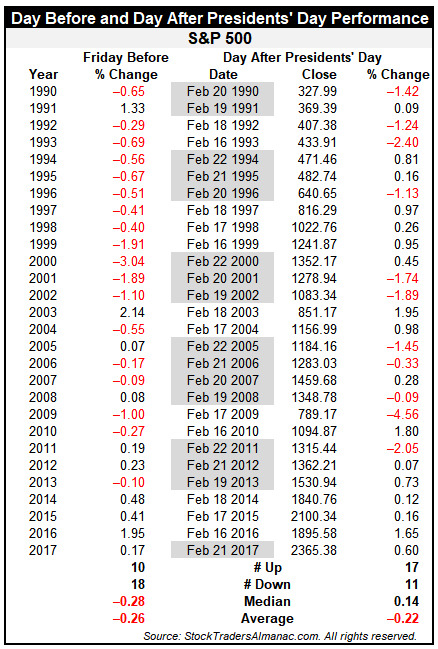

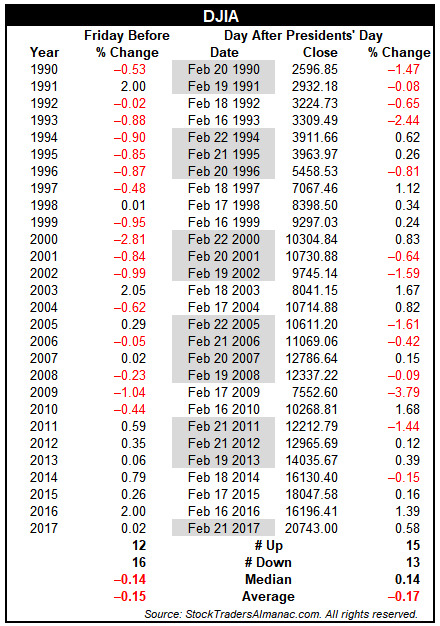

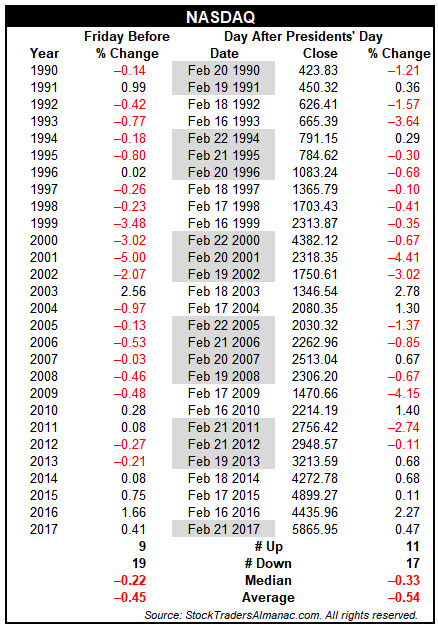

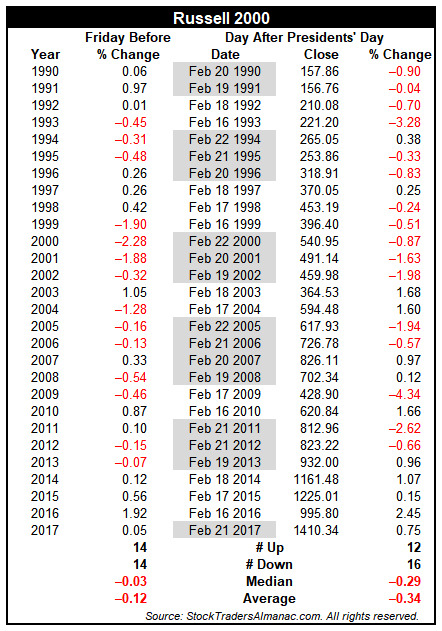

Page 88 of the Stock Trader’s Almanac 2018, points out Presidents’ Day as the poorest performing holiday of the eight holidays that are tracked. Unlike the others, the trading day before and the trading day after this three-day holiday weekend are both down on average over the past 38 years.

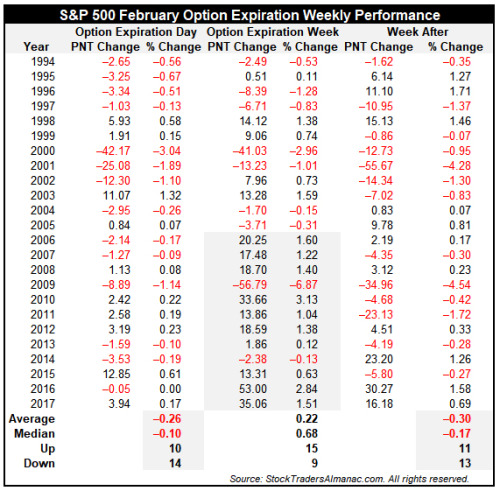

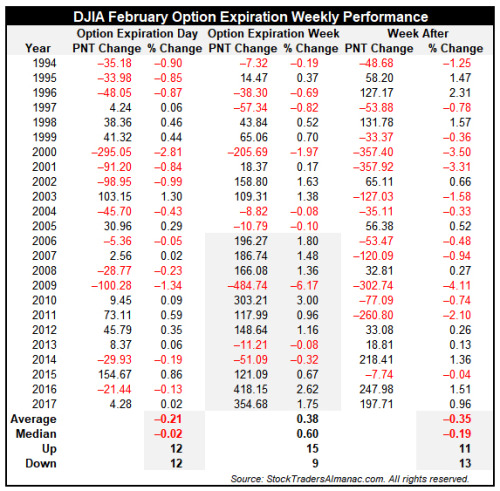

Depending on how February lays out in a monthly calendar, the Tuesday after Presidents’ Day is either the first trading day of option expiration week or the week after options expiration week. In the tables below, the years when Presidents’ Day occurs in the week after option expiration are highlighted. This year, Presidents’ Day falls in the week after options expiration.

Since 2011, the market’s performance before and after the long holiday weekend has improved, most notably during the last four years. Some of this recent improvement could have been the result of sizable losses in January and the ensuing rebound rally. Recent market jitters, a tepid history on February’s option expiration day and a long holiday weekend could be sufficient reason for traders to trim positions this Thursday and/or Friday.

February Expiration Week: S&P 500 Up 10 of Last 12

February’s option expiration day has been down more often than not over the past 24 years with an average loss of 0.26% for S&P 500. Despite a bumpy finish, expiration week as a whole has fared better, but nets an average gain of just 0.22% on the S&P 500 since 1994 with 15 of 24 winning weeks. More recently, S&P 500 has advanced in ten of the last twelve options expiration weeks. The week after, has been down 13 of the last 24 years. DJIA and NASDAQ have similar patterns over the same timeframe.

Join me at The TradersEXPO in New York

Attend The TradersEXPO New York 2018 FREE and Learn How to Become a More Profitable, Consistent, and Confident Trader. While you’re at the Expo, please join me for my workshop: Commodity Trader’s Almanac: Back and Better Than Ever for 2018. Tuesday, February 27, 2018 | 8:15 am - 9:00 am.

After a five-year hiatus, Commodity Trader’s Almanac is back by popular demand, with a new and improved update to reflect changes in the futures markets over the past five years.

This workshop will be part focus group. I will be going over the changes and features of the upcoming NEW Commodity Trader’s Almanac and will be taking your feedback. This will be a once-in-a-lifetime chance to have direct input on what will be in the NEW Commodity Trader’s Almanac!

I will also review all the features of the new edition of The Stock Trader’s Almanac and delve deep into current winter and spring seasonal trade setups in currencies, energies, metals, softs, ags, meats, bonds, and equity indices. I will also discuss the impact and historical implications of the recent correction and how my positive January Indicator Trifecta reinforces our bullish Annual Forecast for 2018.

Over the last few years, we have all seen immense changes that allow individual traders like yourself to trade the markets with the same tools and data available to professional traders. While the plethora of available information offers you the chance to have more accurate charts and a more complete view of the stocks, options, ETFs, or futures you are considering, it can also lead to conflicting buy/sell signals and indecision. This all points to one thing: practical trading education is more important than ever. At The TradersEXPO New York, the entire event is built around this premise.

Register today for The TradersEXPO New York, February

25-27, 2018, at the Marriott

Marquis in Times Square and you and a guest will receive

free admission. Just call 800/970-4355

or register online at

www.NewYorkTradersexpo.com.

Meet and learn from expert traders such as John Bollinger, Tom Sosnoff, Ralph Acampora, Dennis Gartman, Larry Williams, and more than 50 others as they show you the latest trading strategies and tools, discuss cycles, indicators, patterns, and trends, and demonstrate their tried-and-true techniques and analysis that make successful trading significantly easier!

Attend The TradersEXPO and Maximize Your Trading Profitability by:

• Learning timely and practical trading education you can take with you: With 125+ cutting-edge panels, workshops, and live trading demos, you are certain to leave with more confidence and consistency.

• Surround yourself with the best traders in the country: Thousands of traders will gather at the Expo, presenting an exceptional opportunity to learn what is currently working and what doesn’t, directly from your peers.

• Observing the pros as they offer actionable trading strategies and techniques: Over 50 trading experts and educators are lined up and will offer insights on current and impending trends and how best to respond to them.

• Ensuring you’re using the latest and most advanced tools available: The Interactive Exhibit Hall boasts 75+ interactive displays by the leading service and product providers in the trading industry, giving you a rare chance to test drive the best they have to offer.

Don’t miss this exceptional opportunity to gain an immediate and noticeable trading advantage by using the skills you learn at The TradersEXPO. For complete details or to register FREE, call 800/970-4355 or visit www.NewYorkTradersexpo.com.

S&P 500 Resets Correction Clock with 10.2% Decline

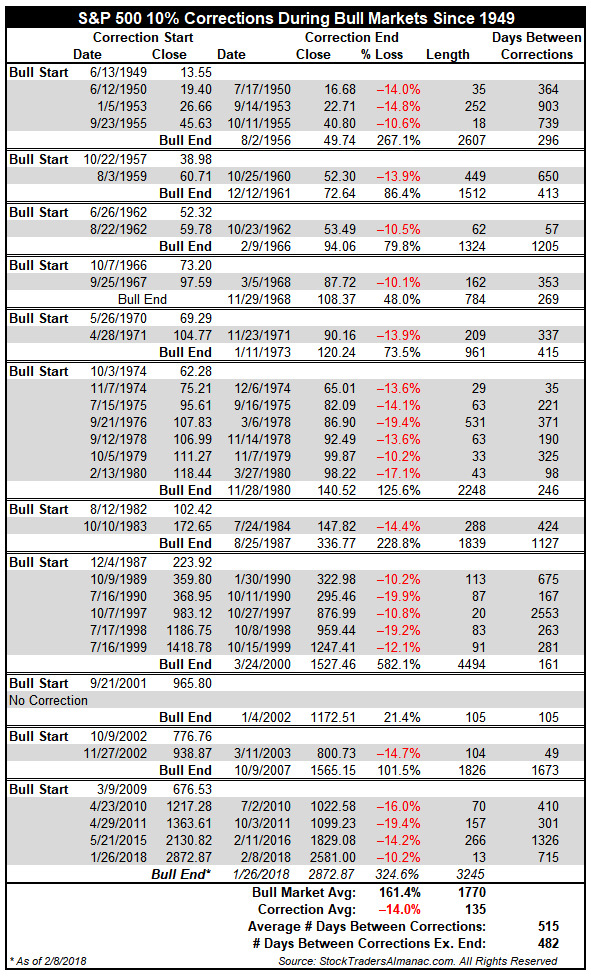

In just 13 calendar days, from its January 26 closing high through yesterday’s close, S&P 500 declined 10.2%—an official correction. Should yesterday’s closing low hold, it will be the quickest correction by S&P 500 going back to 1949. The second quickest correction was 18 calendar days in autumn 1955 when S&P 500 shed 10.6%.

Using a 20% peak to trough decline to define a bear market, the current bull market is 3259 calendar days old today, nearly twice as long as average since 1949. The current bull is also the second longest, surpassed by only the great bull market that closed out the last millennium. The current correction is the fourth of the current bull market which is comparable to the numbers recorded by previous bull markets of similar duration.

The path to recovery from this correction could be slow, but it is only February 9 and over ten and a half moths remain in 2018. Plenty of time remains for the market to finish the year with a gain. The positive implications of past big Januarys and a positive January Trifecta could still be realized.

Lastly, the S&P 500 does not have a good record when it comes to forecasting the next recession. Since June 15, 1948 there have been 11 S&P 500 bear markets and 24 corrections including the current one. Since the future is unknown, we will exclude the current correction meaning there have been 34 declines in excess of 10%. However, the National Bureau of Economic Research has only identified 11 recessions over the same time period. This works out to approximately 1 recession out of 3 S&P 500 declines in excess of 10%.

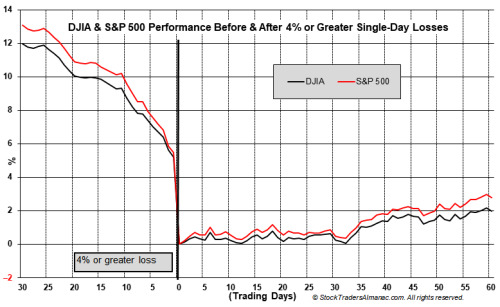

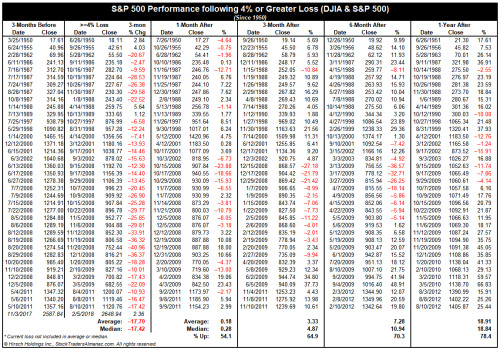

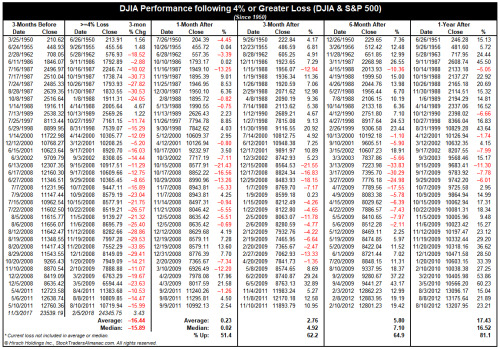

Historically a Slow Road to Recovery After DJIA and S&P 500 Daily Losses of 4% or More

Monday’s greater than 4% declines by DJIA and S&P 500 was just the 98th such time since 1930. To put this number into context, the market has traded a total of 23,130 days since then as of today. The last time DJIA and S&P 500 both declined more than 4% in a single day was in August 2011 when U.S. government debt was downgraded. Prior to then, there were numerous occurrences throughout the financial crisis of 2008 and into early 2009.

Historically, both DJIA and S&P 500 were already in downtrends a vast majority of the time when the 4% or greater single-day losses took place. This is visible in the chart of DJIA and S&P 500 performance 30 trading days before and 60 trading days after above and in the 3-Month performance before the decline in the tables below.

Comparing the historical record from 1930 to present (monster tables available here) or 1950 to present, performance 1-month after the decline is mixed. Average performance is slightly positive and DJIA and S&P 500 are higher only slightly better than half of the time. After 3-months, frequency and magnitude of gains improves, but remain tepid. Further modest improvement is seen at 6-months. However, a full year after there is a significant jump in frequency and average performance especially since 1950.

DJIA’s December Closing Low Holds – Further Declines May Be Averted

There are four key indicators in the annual Stock Trader’s Almanac that we pay close attention too, in addition to a myriad of other technical and fundamental data points. The market’s rip-roaring run through most of January gave us positive readings from the Santa Claus Rally, the First Five Days and the full-month January Barometer. Such strength in January put DJIA well above its December 6th closing low of 24140.91. Thus far this level has held on a closing basis even after DJIA declined over 2000 points which is a positive.

Since 1950, DJIA has closed below its December closing low 34 times in the first quarter. In all but two occurrences (1996 & 2006), it fell further with the decline averaging 10.5% (page 38 STA18). Twenty of the years still enjoyed a gain for the remainder of the year and the full year was up 18 times. Provided December’s closing low holds, January’s positive indicator trifecta is still in play.

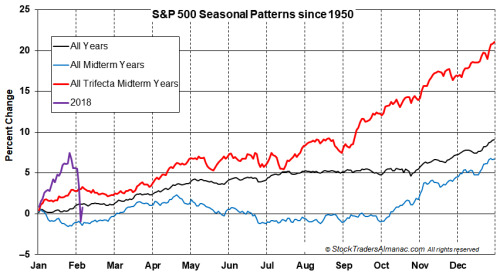

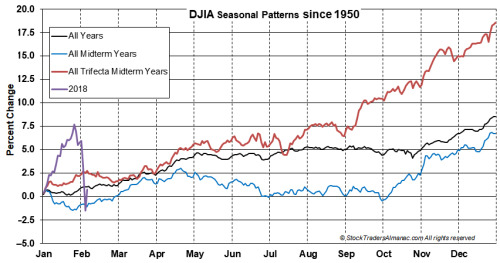

Today’s gains have returned DJIA and S&P 500 to positive year-to-date performance and closer to historical averages for this time of a midterm year. Based upon previous midterm trading, DJIA and S&P 500 now have room to move higher, but at a much more cautious pace than the start of the year. Provided economic data and corporate earnings remain firm; inflation and bond yields steady; and the Fed does not get overly aggressive with rate increases DJIA and S&P 500 could be back near previous highs by the end of April or early May.

First Down Friday/Down Monday Warning of 2018

Today was the worst DJIA, S&P 500 and Russell 1000 single-day point loss on record. NASDAQ and Russell 2000 have actually had larger point declines that today. NASDAQ’s worst daily point decline was 4/14/2000 and Russell 2000’s worst was 8/8/2011. Based upon percent, today’s losses did not even break into the Top 10 Worst Days (this bottom of this list starts around 7-8% losses). Today’s selloff also marked the first Down Friday/Down Monday of 2018. The combination of a Down Friday* followed by a Down Monday** has been a fairly consistent ominous warning.

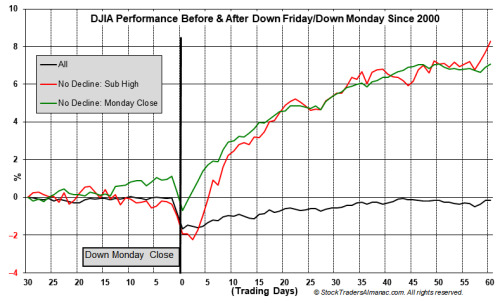

Since January 1, 2000 through todays close there have 191 DJIA Down Friday/Down Mondays (DF/DM) including todays. From DJIA’s closing high within the next 7 calendar days to its closing low in the following 90 calendar days, DJIA has declined 182 times with an average loss of 6.9%. Declines following the DF/DM were greater in bear market years and milder in bull market years (see page 74 of Stock Trader’s Almanac 2018). The eight times when DJIA did not decline within 90 calendar days after were following DF/DMs on October 7, 2002; May 19, 2003; November 17, 2003; February 3, 2014; October 13, 2014; October 31, 2016; September 25, 2017 and October 9, 2017.

When DJIA’s close on Monday of the DF/DM is used as the starting point of the subsequent decline (a lower price), DJIA has declined an average of 5.5% over the next 90 calendar days, but there were 35 times when no further decline occurred. In the following chart, the 30 trading days before and 60 trading days after a DJIA DF/DM have been plotted alongside the 8 times there was no low after the subsequent high and the 35 times there was no lower low after Monday.

Based upon this graph, if DJIA recovers the losses from today’s DF/DM within about 4-7 trading days, then the DF/DM quite likely was an interim bottom. However, if DJIA is at about the same level or lower than now, additional losses are more likely.

*Friday or the last trading day of the week. **Monday or the first trading day of the next week.

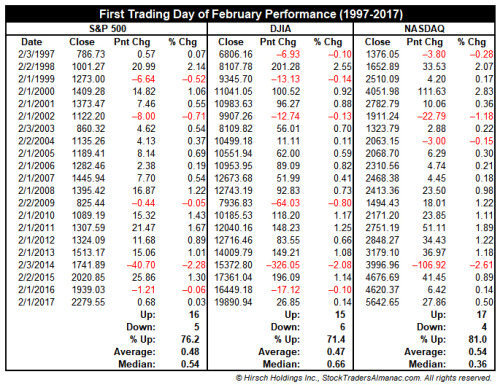

February’s First Trading Day–NASDAQ up 81% of the Time Last 21 Years

After the last two trading sessions, an up day

or even just a flat day would be a welcome reprieve. February’s first trading

day could be that day regardless of today’s outcome. Over the past 21 years,

S&P 500 has advanced 76.2% of the time with an average gain of 0.48%. DJIA

and NASDAQ also exhibit strength. DJIA has been up 71.4% of the time with an

average advance of 0.47%. NASDAQ has been best, higher 81.0% of the time with

an average gain of 0.54%.

Weakness around Fed meeting historically a good opportunity

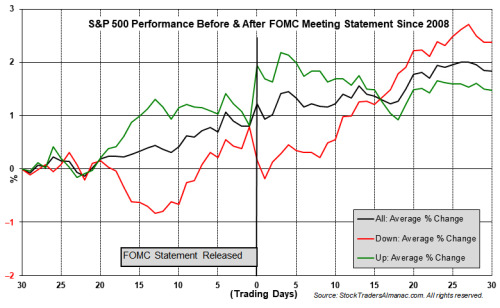

Today, the FOMC will meet for the first time this year and based upon CME Group’s FedWatch Tool there is just a 5.2% chance they will raise interest rates when the meeting ends tomorrow. Instead the next hike will likely be in March when Jerome Powell will be the new Fed Chair.

In the above chart the 30 trading days before and after the last 79 Fed meetings (back to March 2008) are graphed. There are three lines, “All”, “Up” and “Down.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss. Down announcement days have generally been the best buying opportunity while up announcement days were more frequently followed by weakness.

Of the last 79 announcement days, the S&P 500 finished the day positive 47 times. Of these 47 positive days S&P 500 was down 27 times (57.4%) the next day. Of the 32 down announcement days, the following day was down 17 times (53.1%). All 79 announcement days have 0.43% average S&P 500 gains while the day after has been a net loser with S&P 500 declining 0.30% on average.